Welcome to the Labor Day Edition of the Carnival of Financial Camaraderie!

Enjoy perusing all the great entries this Labor Day and please take a moment to share a salient post or two on your social media platforms and through your blogs. Also remember, this carnival is hosted every second week by My University Money and you can submit articles at Blog Carnivals or Blog Carnival HQ.

BUDGETING

Everything Finance @ Everything Finance Blog writes Are You Still Working Without a Budget? – Let’s face it, budgeting is kind of hard—you’re trying to implement a system for tracking your expenses, and since you’re probably spending by check, debit and credit cards, and cash, keeping it all in order can be a challenge. And they don’t teach personal budgeting in school either, so how do you learn?

Steve @ Canadian Personal Finance writes Is it OK to get a discount if you are good looking? – Would you turn down a discount because you were good looking? A customer received a discount for being good looking. This was simply a joke by the server but honestly it brings up a good question, do good looking people get discounts?

Steven @ Grocery Alerts writes 3 Monthly Expenses to Cut to Save you Money – Although monthly expenses don’t seem like very much, but they can really add up. For example, a $100 cable bill on a monthly basis equates to $1200 at the end of the year. Here are a few tips on some monthly expenses that you could consider cutting.

Steven @ Grocery Alerts writes How you can fly first class to Hawaii for under $350! – For approx. $328 you can obtain 30,000 Saga Club miles which will get you a FIRST CLASS roundtrip ticket on Alaska Airlines to anywhere they fly in the U.S. (Alaska and Hawaii included) Canada and Mexico.

CAREER & EDUCATION

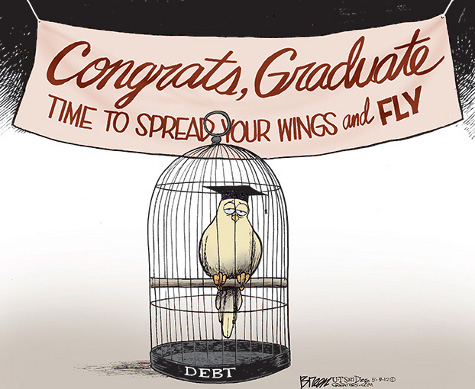

Evan @ My Journey to Millions writes Analyzing the Prepayments on One of My Student Loans – As I made my monthly payment the other day on one of my student loans I wondered how much I have saved in interest over the years by adding to the principal some months. Since the lender didn’t provide me with that information I almost looked at it as a challenge to see whether I could figure it out.

Edward Antrobus @ Edward Antrobus writes 3 Job Search Tips for Recent Graduates – It’s a tough economy for recent grads, but these three job search tips can help you land your first job after graduation.

FINANCIAL ADVICE

MR @ Money Reasons writes My Personal Finance Pyramid Update – I use a Personal Finance Pyramid to provide feedback as I strive to acquire wealth in life for me, my family and my kids!

harry campbell @ Your Personal Finance Pro writes How to Take Advantage of Credit Card Sign Up Bonuses – I got my first credit card when I was in college and I used it for most of my entertainment(see alcohol) and dining out purchases. Since then I’ve applied and been accepted for over 10 credit cards with sign up bonuses and gotten thousands in gift cards, travel rewards and cash(wow that sounds like a scam! But it’s true). So here’s how I do it.

Aaron @ Aaron Hung.com writes How many credit cards are too many? – There comes a time in your life when you need to make a big purchase such as buying a house to raise your family, or for investment purposes. Going to big name lenders is usually the way to go when looking for capitals to buy your dream house

PPlan @ Provident Plan writes What’s the Most Effective Way to Give? – The most effective way to give is one that provides sustainability and the most bang for your buck. Find out what else gives a gift the biggest impact.

J.P. @ Novel Investor writes Options For Your 401k Rollover – When you leave your job, do you really want to leave your retirement savings behind? There are several 401k rollover options available so you can take your retirement savings with you and have better control of that money.

Jeremy @ Modest Money writes Compare The Best Credit Card Offers – Personally I pay off my balance in full each month and earn cash back on all my card purchases. Plus by using my credit card I am entitled to extra buyer protection. Hey, works for me. It does not work for everyone though. For people who can control their spending, I present a comparison of the best credit card offers.

Mr. Money @ Smart on Money writes Why You Should Have Life Insurance Even If You Are Young and Healthy with No Dependents – The thing is, even if you’re young and healthy there may be quite a few good reasons for you to buy good term life insurance. It isn’t just for old people, you know!

Peter @ Bible Money Matters writes Paying Down Debt? Make Sure to Recognize Non-Financial Progress – If you have had to take a break from debt repayment and feel discouraged, ask yourself if any of these situations apply to you. If so, pat yourself on the back. You are progressing in your war on debt, just not in a gazelle intense monetary way. You know you are making progress on your war on debt if:

FRUGALITY

Michelle @ See Debt Run writes Crock Pot Piggy Bank – You can save a lot of money by making your own crock pot recipes. Eating healthy and fresh doesn’t have to be more expensive!

Wayne @ Young Family Finance writes How to Raise a Child on a Budget: Identifying the Necessities – Find out how you can raise a child on a budget. Spending less on your children doesn’t mean sacrificing the love given to them.

Amanda L Grossman @ Frugal Confessions writes Simple Childhood Pleasures – Aside from going to Ocean City MD each summer, I have realized that most of the fun I had in my childhood was simple and cheap.

Miss T. @ Prairie Eco Thrifter writes Frugal Dating and the Fun Factor – Saving money and being frugal can be boring sometimes, but it doesn`t have to be. Making a date night fun by thinking outside of the box while still saving money can be helpful to your relationship and your finances.

INVESTING

Shilpan @ Street Smart Finance writes The Best Investment Strategy for Growth and Income – There is no doubt that both value and growth investing styles have their share of staunch followers. Those who believe in Graham and Warren Buffett’s value investment style believe that growth investing is for roulette players. On the other hand, growth investors believe that value investing is a thing of the past with mediocre return at best for the serious investors.

Matt @ Dividend Monk writes Gordon Growth Model Overview – A description of the simple method to determine a fair price to pay for most stable, blue-chip companies.

IMB @ Investing Money writes How to Get Started Investing Money – Find out how you can get started investing money. It’s never too early to start.

Corey @ Steadfast Finances writes Unusual Investment Ideas – Looking for nontraditional investment ideas? Look no further. While these may not be as safe, they could provide you with positive returns.

Hank @ Money Q&A writes Don’t Be Fooled Into These Life Insurance Policies – Here are five of my favorite insurance life policies that I love to hate. You don’t need these five life insurance policies. Don’t waste your money on them.

Eddie @ Finance Fox writes Maybe Home Ownership Isn’t For You – There is more to life than home ownership, and it isn’t the only way. If you ENJOY owning a home, more power to you. But not everyone does.

My Own Advisor @ My Own Advisor writes How many dividend stocks are enough? – I guess one goal for dividend investors should be to reach a saturation point whereby the addition of one more stock in the portfolio marginally reduces volatility. To reach this goal, you’re gonna need more than a few stocks I’m sure… Read on to find out what I feel, is a healthy amount of stocks to own for diversification purposes.

BARBARA FRIEDBERG @ Barbara Friedberg Personal Finance writes CAN YOU RELY ON THE 4% RULE IN RETIREMENT? – Are you properly preparing for retirement? Read about retirement issues to consider.

krantcents @ KrantCents writes Home Gym on a Budget – Would you like a home gym? All the movie stars have a home gym and you can too! Do you have to be a movie star to have one? No, not really! In fact, you can put one together for very little money.

Jen @ Master the Art of Saving writes My Plan to Save a LOT of Money – We’re planning to close on our house the first or second week of September, so we don’t have much time to save a lot of money. My goal is to take advantage…..

TRL @ The Retired Landlord writes Real Estate Investing is Easier with Positive Cash Flow – If you are looking to invest in real estate, as I am looking to do, I have learned that a positive monthly cash flow is important to have. As I have already discussed, real estate investing has risks. There is a chance of having to pay the mortgage between tenants or losing money with major maintenance issues.

Kanwal @ Simply Investing writes 9 Important Reasons Why Dividends Matter – I came across a great article at Dividend Growth Stocks that I would like to share with you: “It seems that every financial adviser or financial publication is proclaiming that you should own dividend stocks. Each are proclaiming the virtues of dividend stocks from their own perspective. To that I have two questions: 1. What took you so long? 2.

Debt Guru @ Debt Free Blog writes Get debt Under Control and Start to Enjoy Life – Find out how to pay off your debt and enjoy life as you prepare for retirement.

Investor Junkie @ Investor Junkie writes Four Top Investment Mistakes You are Making Today – Investing is a task unlike any other. Rarely is there an opportunity to outperform just by avoiding the big mistakes. The truth is, though, that the best investors aren’t those that hit home runs. The best investors simply avoid big mistakes.

SAVING

Deacon Hayes @ Well Kept Wallet writes Why it Pays to Go Back to the Store – Every time I go to Fry’s, they post the ads on the right as soon as you walk in the door. I have made it a habit to go over to see if there is anything that is a good deal or worth looking at. Well, this time I noticed that a radio I had bought within the past 30 days was on sale for $20 less. I remembered that they had a price match guarantee and decided I would ask if they would give me the difference.

Jefferson @ See Debt Run writes Four Great Uses For a Savings Account – http://seedebtrun.com/2012/08/4-great-uses-for-a-savings-account.html

Passive Income Earner @ The Passive Income Earner writes Kids and Money: The Bank Card Introduction – Introducing the bank card to children. It’s a delightful experience.

OTHER

SB @ One Cent at a Time writes How to replace HP Laptop – Effectively managing financial institution accounts is equally important as saving money. Still we don’t usually put much attention on managing side of the personal finance. In personal finance, diversification is as important as managing that diversified portfolio. Do it effectively

Ryan @ Early Retirement Investments writes Some Signs that You Need to Convert to Heat Pumps – Confused on whether you should have a heat pump or not? Read more to see if it makes sense for you!

Jon the Saver @ Free Money Wisdom writes Why Do We Worry About Money? – Worrying about money is not helpful in life. It’s better to plan and not worry so much about it. Money does not need to consume your thoughts.

Suba @ Broke Professionals writes 5 Easy Ways to Irritate Your Boomer Boss – 5 Easy Ways to Irritate Your Boomer Boss is a post from: Broke Professionals if you enjoy it, please visit us and subscribe to the Feed.

Jason @ Work Save Live writes Popular Jobs in Tax Friendly Countries – With all the debate around Mitt Romney’s possible assets overseas, it makes you wonder more about the places like Gibraltar, Andorra, the Cayman Islands and more. These places are known as tax shelters, and as such, they usually have a lot of bankers and financial institutions in place.

Corey @ 20s Finances writes Do You Remember Your First Time? – Getting approved for a credit card without having any previous credit history can be a challenge. Find out what you can do to get approved.

Roger the Amateur Financier @ The Amateur Financier writes The Success of Others and My Motivation – A discussion of how the success of other people influences me, and how such success (and the converse failure) can influence everyone.

Jester @ The Ultimate Juggle writes Family Spending Choices Versus Family Wants – Struggling to balance the best mix of family spending and saving for the future.

Daisy @ Add Vodka writes An Unsent Letter to People Who Are Selling Things – Dear whomever this may concern: While I appreciate your drive to make money so that you can buy winter booties for your dog and another cardigan sweater from BCBG instead of paying down your debt, please stop sending me sly. Read more of my unsent letter!

Ashley @ Money Talks Coaching writes Trying to Get My Daughter to Save – I’ve mentioned several times that my daughter really doesn’t get money. She doesn’t care to earn it. She doesn’t care to keep it.

Aloysa @ My Broken Coin writes My Not Quite Traditional Marriage – When we met over seven years ago, both of us were poor. I was a full-time student, working full-time, my spending problems were in full gear, debt piling up.

SFB @ Simple Finance Blog writes Minimalism At Home: Do I Really Need Six Sets of Sheets? – I hate laundry day; or, rather, when you have two children under the age of four and a husband who changes clothes more often than a budding fashionista, it’s more like laundry days. Despite that, I still follow my mother’s old adage that you should wash your bath towels weekly and your bed sheets every…

Shawanda @ You Have More Than You Think writes Secret Tricks to Grabbing the Best Travel Deals – Making the most of your travel dollars will give you peace of mind and set the stage for a relaxing vacation.

JP @ My Family Finances writes Reasons Why Families Need to Get Life Insurance: Take It From a Guy Not Trying to Sell You a Policy – There are plenty of convincing reasons for buying life insurance; I need not frighten you.

Don @ MoneySmartGuides writes Can People Not Save for Retirment? – Teresa Ghilarducci is back again. I previously wrote about her wanting Guaranteed Return Accounts (GRA) for Americans back in July of 2010. She is still advocating these accounts, now with updated numbers to make her point.

Jennifer Lynn @ Broke-Ass Mommy writes The Best Piece of Writing Advice, Ever. – This is the best information on writing advice that I know of, read more to see if you agree.

Sustainable PF @ Sustainable Personal Finance writes Which is the Greener Option – Shopping Online or Shopping at a Store? – Shopping online has become the method of choice for many people but I’m still not convinced it’s for me.

John @ Married (with Debt) writes The Savings to be Made from Paying Off Your Mortgage Early – The savings to be made from paying off your mortgage early For most Canadians, the biggest debt they will ever have is a home mortgage.

A Blinkin @ Funancials writes How To Lose Money and Hate The Stock Market – Do the exact opposite of what you find in this article and you will be on your way to riches. Find out how to lose money and hate the stock market. Don’t meet with your adviser regularly. Check your brokerage account or stock daily. Watch the news. Take stock-picking advice from a friend. Buy high, sell low.

Crystal @ Budgeting in the Fun Stuff writes My Take on Life Insurance – Today, I am participating in the huge Life Insurance Movement in the blogging world that was started by Good Financial Cents. Here is my life insurance take.

Daniel @ Sweating the Big Stuff writes Five Wedding Gifts You Shouldn’t Buy For A Friend – Some gifts are appropriate for specific audiences. Others will almost definitely be returned. Here are five gifts that you shouldn’t get for friends.

Ted Jenkin @ Your Smart Money Moves writes When Should You Replace Your Old Car For A New One? – When it comes to making smart money moves, our family has never been a big fan of buying a new car.

PITR @ Passive Income To Retire writes Hidden Risks of a Mortgage Fine Print – Find out how to avoid the most common mortgage mistakes.

Invest It Wisely @ Invest It Wisely writes Are You an Introvert? Here’s How to Make the Most of Your Conference Experience – If you are introverted, read how to make the best of conferences!

Luke @ Learn Bonds writes How to Choose a High Yield Bond Fund – Interested in choosing a high yield bond fund but not sure where to start? Here is a 6 step guide walking you through the entire process.

SBB @ Simple Budget Blog writes Simple Ways to Cut Monthly Expenses – Do you need a little extra cash? We offer simple ways for you to save money without it being a huge inconvenience.

Kevin @ Thousandaire writes 4 Reasons We May be Headed for a Recession – Read these four reasons that we might be heading for a recession, see if you relate!

Maria @ The Money Principle writes The Rise in Health Negligence Payouts – Policies has effects and in this article the increase in health negligence payouts is discussed.

YFS @ Your Finances Simplified writes 5 Ways Marriage Can Make You Richer – The cake has been cut, the champagne cork has been popped, and confetti has been strewn all over the place.

L Bee @ L Bee and the Money Tree writes Taking a break matters! – Hey guys, I’ve been away for about a week or so while technical issues with my self-hosting site get ironed out. Even though I was on “vacation” with my blog I was still in training for my part-time gig and …

SB @ One Cent at a Time writes 10 Tips to Avoid Internet Fraud and Scams – In most cases of online scams, people are either careless or ignorant. That is the reason they are cheated quiet easily. Following are the 10 ways to protect yourself from being cheated in to scams and frauds

SB @ Finance Product Reviews writes Kiva Microloan Review – an Attempt to Understand Kiva – This is review of Kiva micro-loan program. Is Kiva legit, is Kiva worth it. Learn more about the allegations against Kiva. Learn how can you lend to Kiva or borrow from Kiva.

~¤~¤~

More nifty carnivals to make your eyes bleed:

Carnival of MoneyPros at Simple Finance Blog

Carnival of Retirement at My Family Finances

Carn. of Financial Camaraderie at My University Money

Wealth Artisan’s FinCarn at Wealth Artisan

Y & T’s Weekend Ramblings at Young and Thrifty

Happy Labor Day!!

=^..^=