Jan 8th, 2013 by Jennifer Lynn

I am on a quest for that perfect bag.

For the past few years I have been hauling around an ultra cheap purse that quite literally is on its last threads. Little bits are starting to flake off the strap and the seams are becoming undone. The bottom is spongy and torn and getting ready to let loose. I figured it was time to buckle down and make a serious effort to do some bag hunting to find a suitable replacement.

And being that Lexi and I are grappling with nasty colds, which has made it difficult to concentrate on anything productive these last two days, I used the opportunity to fudge around online and mindlessly browse for some price options. Meanwhile I am trying not to bash my head on the keyboard. (This is the third time I’ve had to stop to blow my nose since starting this paragraph, yecch.)

I envisioned a quality mid-cost leather satchel for all of my essentials: bottled water, a mini tablet, a journal and pen, my cell phone, a wallet or pouch for credit cards and my keys. Something cute and original. Perhaps a tad boho-esque, with a charming dash of Indiana Jones.

However I have no clue what an efficient price threshold for a quality mid-range leather bag is. $100? $300? As I am researching these things, Etsy has been an addicting solution for stumbling upon that perfectly unique handmade or vintage bag.

I despise head colds and my inability to concentrate BUT I have discovered some darling bags on Etsy during my down time. ![]()

handmade leather-canvas backpack. (Source: Etsy)

I love the generous size and the earthy tones of this unisex leather-canvas backpack. I really admire that faded beat-up look and this handmade pack looks to be of decent quality. I could definitely see this pack accompanying me on many different adventures. Original, and just too adorable! ($85.00 by SandyLeatherBag)

vintage camel leather messenger. (Source: Etsy)

The description says this vintage camel leather messenger is for men but I totally would use it! I love how durable this bag appears and depending on how easy those buckles unsnap, it might be the perfect bag for a writer. At 18″ however, this is probably a bit too bulky for my personal preference. ($89.00 by Genuine Goods)

And for the romantic at heart…

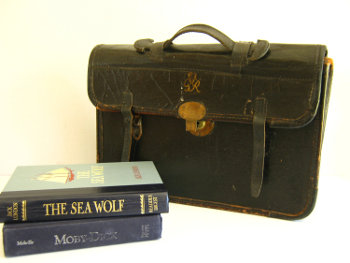

an antique leather satchel. (source: Etsy)

Seriously, how cool is this?? According to the seller, this is an antique leather satchel from the early 1900′s that once belonged to a British officer in the Royal Navy and it has spent an entire life at sea. Talk about an abundance of character in every ding. This beautiful one-of-a-kind antique satchel may require special treatment and extra TLC but it is sure to inspire the dreamer and poet in all of us. ($60.00 by Rolling Hills Vintage)

I always feel a bit reluctant to purchase a big ticket item without being able to touch or view it first. Have you used Etsy before? What is the most you would spend on a bag?

Okay, time to tend to Lexi. She is getting very restless and is a bit uncertain on how to deal with all of the mucous oozing through her system right now. The poor wee mite.

Until next time. Sniffle. Cough.

=^..^=