Nov 21st, 2012 by Jennifer Lynn

After a slight pause due to car toil and trouble, M. and I have successfully smoothed over and revived our envelope system of savings, despite facing a semi-dissolved emergency fund. We were looking into online savings account rates as well to help speed up our savings.

We cracked open the budget last night to fiddle with the viability of working toward previous goals while simultaneously re-fluffing our emaciated emergency fund. Then a tense forty minutes was spent on relentlessly nudging, jabbing and cleaving at the numbers until we could reconcile a functional solution, which we managed to do, and which is genuinely excellent.

It was stressful calculating where nearly every penny had to go but we did chisel away a teensy percentage that was being frittered away on rubbish, like unnecessary entertainment costs, which instead would be veered into our specific savings goals (such as purchasing a king-size mattress, also gravely needed at this point), in addition to re-plumping our emergency fund. And instead of trying to scrunch all of our objectives together, we decided to intensely focus on a lone goal and scrape it from the agenda before continuing forward.

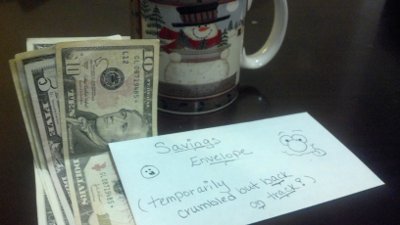

We even inaugurated our little savings envelope with a dab of cash: nearly $20 from a massive pile of bottle returns, hah!

Our savings envelope, back on track.

It feels lovely to be progressing forward.

Baby steps.

Fellow peoples: although I enthusiastically support giving hearty obscenities toward insatiable consumerism and other such blatant nonsense represented by Black Friday, I still would like to wish everyone a truly joyous holiday weekend.

Happy Thanksgiving, from Lexi and me!

=^..^=